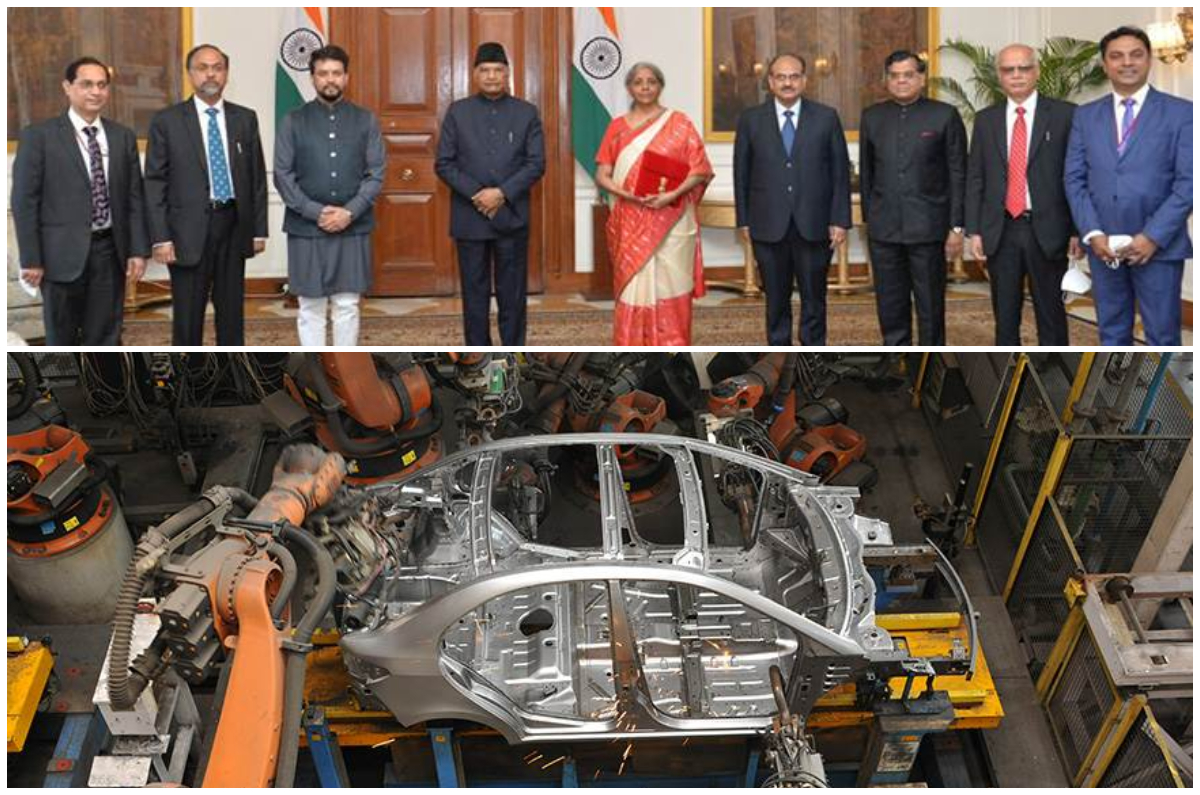

Budget 2021 strikes the right cord for the auto industry

Budget 2021 should be seen as a good thing for the auto industry. Finance Minister, Nirmala Sitharaman, announced a vehicle scrappage policy, funds were earmarked for highway development and the intent towards Atmanirbhar Bharat was constantly articulated during her nearly two-hour long speech.

- Budget 2021 underlined local manufacturing needs to increase

- Infrastructure development expected to lead to increase in personal mobility

- Scrappage policy still requires clarity on certain issues

- Privatisation of Bharat Petroleum Corporation to help gain revenue

- Great Wall Motors among the Chinese brands whose India plans are on hold

Some automotive components have become more expensive due to higher import duty levies. In the process, the Budget sent out a strong signal to Indian industry that local manufacturing is the need of the hour. How companies manage to offset this price hike remains to be seen.

It is a significant Budget because purse strings have been loosened for the first time in many years without the constant obsession about the fiscal deficit. There was really no way out actually considering that the pandemic ravaged the economy and the Centre had to do its bit in sending out the right signals both within the country and to global investors.

The Budget’s focus on infrastructure will also see accelerated Metro work development happen in some parts of the country, which in turn will give a huge leg up to personal mobility. The impact will be felt on auto rickshaws and taxis, as well as Uber and Ola, except that all this is still some years away.

Some questions will still need to be addressed on the scrappage policy, which will extend to cars and trucks. How will the Centre compensate those owners who surrender their vehicles? Perhaps this will be in the form of a hefty road tax instead, where there is no way out but to give up on their decades-old possessions.

While greater clarity is needed on the subject, there is no questioning the motive, which is long overdue. These polluting vehicles have fouled up the air for many years now and it is high time that they are consigned to the scrap yard. This becomes even more relevant at a time when the country has transitioned to Bharat Stage 6 emission norms and the exercise becomes futile when old vehicles are still operating on the roads.

It is also very likely that the GST Council may be more open to the idea of reducing the levy on all vehicles from the present level of 28 percent to 18 percent. For some time now, the concern has been revenue generation but in an abnormal/surreal year where COVID-19 has knocked the stuffing out of the economy, concessions must necessarily be made. It is the only way customers will start spending more and contribute to the India growth story.

As for Atmanirbhar Bharat, a move in the direction has already been made with the Centre’s PLI (production-linked incentive) scheme, which includes the automotive industry among a host of other sectors. Through this initiative, manufacturers can now go flat-out with their localisation plans and do their bit in reducing imports.

In this backdrop, where China continues to raise India’s hackles in the border standoff and has fuelled the Atmanirbhar drive, it is a million dollar question if some key investments will see the light of day. Great Wall Motors, for instance, has been waiting for over a year now to take over General Motors’ Pune facility. Going by current sentiments, this is not likely to happen in a hurry which means other entrants like Changan Automobiles and FAW will also need to press the pause button for their India entries.

From the Centre’s point of view, it is absolutely imperative to get its disinvestment programmes back on track in order to get the much needed revenue. The target for this year is Rs 1.75 lakh crore, of which, the sale of Bharat Petroleum Corporation will account for a lion’s share. Going by market sentiment to the Budget, the Centre will be hoping that the tailwinds continue to be fierce enough for investors to queue up for BPCL as well the initial public offering of Life Insurance Corporation.

The Budget presentation was made less than a fortnight after a change in administration in the US where Joe Biden was sworn in as President on January 20. These are not the easiest of times in a world that is seeing huge tumult due to a slew of factors such as job layoffs, huge protests in countries like Russia, and the growing discomfort with China. As India gears up for these challenging times, a good beginning has been made with the Budget hitting all the right notes. It is now up to all the stakeholders concerned to keep the story going nicely.

Also see:

Union budget 2021: Vehicle Scrappage policy announced by Finance minister

Virgin Hyperloop releases new details on passenger experience

Delhi performs the worst, Kolkata the best in Ford road safety survey

No comments

please do not enter any spam link in the comment box