Global car sales down 39 percent in March 2020 due to coronavirus

As the world tries to make a difficult return to normalcy after getting battered by the Covid-19 pandemic, the underlying economic implications of preventive nationwide lockdowns enforced in various countries are increasingly coming to the surface.

The automotive industry has been one of the worst hit sectors due to the big ticket nature of products. The higher price tags keep buyers away from discretionary spending in these times of global economic uncertainty.

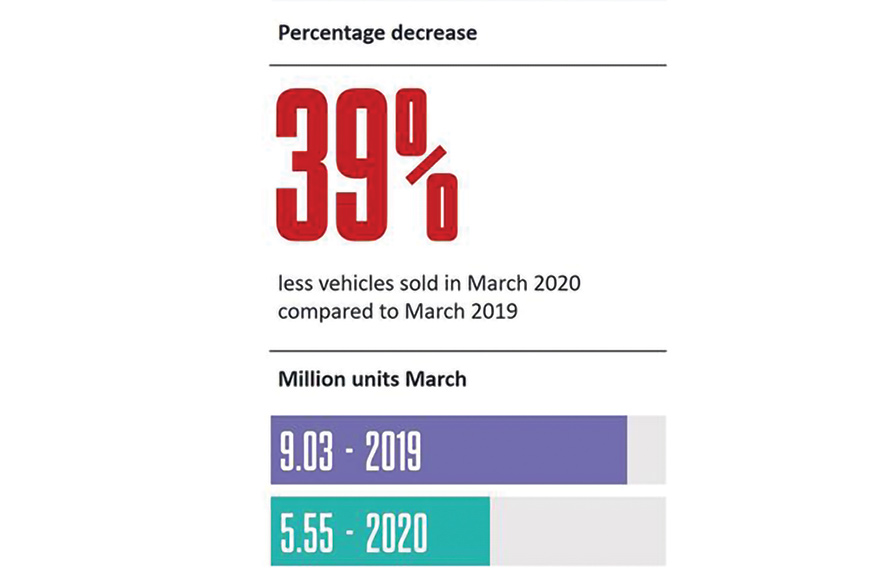

Global vehicle sales in March 2020 dropped to 55.5 lakh units (March 2019: 90.3 lakh / -39 percent). This is due to the fact that most non-essential services including vehicle production and sales had been brought to a complete standstill in countries such as the US, Germany, China, India and the UK.

Europe worst hit, EVs on the rise

According to a report released by Jato Dynamics, even as China and the US posted double-digit declines, Europe was the worst hit, with March numbers plummeting to a record 38-year low. The combined passenger car registrations for all 27 countries part of the ‘Europe-27’ group tallied 8,48,800 units, registering a 52 percent year-on-year drop.

However, the report suggests that de-growth in these fresh registrations varied from country to country. So, while Finland, Lithuania and Sweden recorded marginal fluctuations ranging between 1 and 9 percent due to the less severe isolation guidelines mandated by their respective governments, the octet of Italy, France, Spain, Austria, Ireland, Slovenia, Greece and Portugal recorded a substantial 74.5 percent drop in collective sales - from 6,34,600 units in March 2019 to 1,61,800 units last month.

Furthermore, while all passenger vehicle categories were affected in Europe, city cars, MPVs and smaller vehicles felt most of the impact. The report explains this phenomenon occurring because of the collapse of the Italian and French markets, which are heavily reliant on small cars for sales. For instance, 38 percent of all A- and B-segment registrations came from these two countries in 2019. On the other hand, what sprung as a surprise was the D-segment led by the all-electric Tesla Model 3, which emerged as Europe’s bestselling car in March.

Electrified vehicles including hybrids, plug-ins and full-electrics, in totality, were able to record an uptick of 15 percent in their registrations to 1,47,500 units in the month. This segment also clinched a 17.4 percent market share, which is a new record and an an increment of 10 percentage points compared to March 2019.

Other than Tesla, electrified versions of vehicles from the stables of top automakers including Volkswagen (+240 percent), Volvo (+79 percent), Mercedes-Benz (+44 percent), BMW (+15 percent) and Hyundai (+25 percent) also saw a spurt in sales. However, even as consumers were seen shifting to eco-friendly vehicles, the full-electric and plug-in sub-segments that recorded growth, while sales of conventional hybrids went downhill by as much as 11 percent in the continent. The Volkswagen e-Golf, e-Up, Audi E-Tron, Mini Electric, Peugeot 208-e and the MG ZS EV together accounted for 17 percent of all registrations of fully-electric vehicles.

Even as it’s been a trending vehicle category and the preferred body style for most car shoppers around the world for quite some time, registrations of utility vehicles dropped by almost half to 3,38,300 units, albeit, having still increased their market share to over 40 percent in Europe last month. From an individual manufacturer’s point of view, while MG Motors doubled UV sales from 1,327 to 2,592 units and Volvo’s XC40 became the top-selling premium model, the Range Rover Evoque registered a drop of 3 percent to 5,700 units.

Car sales in India down 51 percent

India, the fifth-largest passenger car market in the world, has been indoors since March 25, forcing a cessation of all non-essential activities in the country. It has brought the auto industry to a grinding halt. The PV segment posted a significant 51 percent decline in the month of March with total sales of 1,43,014 units (March 2019: 2,91,861). The ailing sales of PVs were amplified by the coronavirus crisis. Footfalls reduced just before the government’s announcement of a nationwide lockdown and held back buyers who wanted to finalise lucrative deals on BS4 models. There were great deals to be had before the cleaner, and more expensive BS6 emission technology-equipped cars became mandatory on April 1.

“This downward trend is not simply due to the restrictions of free movement. The industry is being impacted largely by the uncertainty for the future, and this issue started to arise even before the pandemic took hold. We have to remember that the industry was already operating in a challenging environment, especially towards the end of last year. The trade wars, lower economic growth and tougher emissions regulations came long before the Covid-19 crisis. And unlike previous recessions, we’re not just dealing with people’s fears or purchase delays. This time we have to consider that consumers are simply unable to leave their homes,” said Felipe Munoz, global analyst, Jato Dynamics.

Americas badly impacted too

The US emerged as a ticking time bomb with the country taking too long to act and announce a proactive lockdown. With mere self-quarantine guidelines, the country still posted a 38 percent drop in sales to 10 lakh units. According to Munoz, “The US market’s growth slowed last year after many years of witnessing strong growth. At the beginning of 2020, we expected the market to face a slow stagnation; however, this is now more likely to decline to a faster pace due to the impact of the global pandemic.”

Demand in Latin America fell by 30 percent to 3,18,000 units, following restrictions in Argentina, Colombia, Chile, Peru, and more recently Brazil and Mexico. The volume was also affected by the economic crisis in Argentina, the region’s third-largest market.

China on the road to recovery

With the epicentre of the coronavirus pandemic having managed the situation to some extent and the 76-day lockdown in the city of Wuhan getting released on midnight April 8, China could well be on the road to recovery.

According to the report, there has been a significant improvement in the Greater China region with the insurance volumes reaching a cumulative 10 lakh in the month, determining a 38 percent year-on-year decline, compared to the 78 percent drop in the month of February.

“We are positive about the state of the automotive industry in China. Sales figures are on the rise and businesses are returning to normal as remote working is being lifted. COVID-19 will have a lasting impact on the working world and how people across the globe choose to travel. As social distancing continues and consumers start to place greater emphasis on personal space, private car sales are likely to benefit. We continue to closely monitor the environment but early indications from the Chinese market could signal a potential resurgence for OEMs as we move into the post-Covid-19 era,” commented Bo Yu, country manager for Greater China, Jato Dynamics.

No comments

please do not enter any spam link in the comment box